Mission Map

Here are a few destinations you can explore to rebuild or establish credit, some are affiliate links. Think of this as a curated financial tools guide. We earn commissions when you shop through the links below at no additional cost to you.

Credit Builders

A secured card, requires a security deposit. We suggest a balance below 10%, pay on time. We’ve partnered with Credit Builder Card (CBC), they report to three major credit agencies: Equifax, Experian, and TransUnion. Other personal picks:

- Discover It Secured: No hidden fees, online payments, and my deposit was returned in under a year. Responsible use led to a credit limit increase and a noticeable score boost.

- Capitol One Secured: Another solid option for building credit with flexibility.

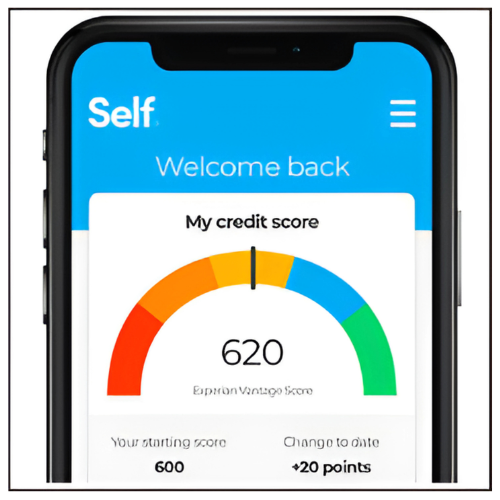

An alternative to a secured card is Self Inc. Self’s Credit Builder Account helps you build credit by making monthly payments into a locked savings account. Payments are reported to all three credit agencies, and you get your money back (minus fees) at the end. You may also apply for a secured credit card. Fund your card’s deposit with just $100.

Now, let’s explore another strategic tool, a line of credit. Like a credit card, it offers revolving access to funds, but with more flexible repayment terms and often lower interest rates. Kikoff does not conduct a credit check during the application review process. They offer a line of credit, therefore, you’ll have a credit mix which could optimize your score.

To add, rent is often our biggest monthly expense, but unlike credit cards or loans, it rarely shows up on our credit report.

However, by using rent reporting services, such as Rent Reporters, could be beneficial.

Lastly, Upstart offers fast, unsecured personal loans with no prepayment penalties. And yes, you can check your rate with no impact on your credit score.

Upstart is an online lending platform that uses artificial intelligence (AI) to connect borrowers with lenders.

Credit Monitoring

SmartCredit is a trusted platform we’ve partnered with to put you in charge of your credit score, simplify managing credit, money, privacy, and address factors affecting your credit score to improve your credit outlook.

Smart Credit offers credit monitoring, score tracking, and personalized guidance, plus access to all three credit reports, $1 million in fraud insurance, and privacy protection. You can also track spending, receive alerts, and explore loan offers matched to your credit profile.